Gujarat’s business world gets ready for the annual financial year-end rush as March fades. From corporate headquarters in Surat to busy marketplaces in Ahmedabad, the air is charged with urgency. Companies rush to finish accounts, assure tax compliance, compile financial statements, and plot for the next fiscal year. This duration sees more departmental collaboration to guarantee accuracy and compliance. Especially active are small and medium businesses (SMEs), the backbone of Gujarat’s economy. Their priorities include organizing inventory, settling outstanding invoices, and evaluating financial situations. There is much urgency; long working hours are now the standard. This group effort guarantees that companies begin the new fiscal year from a strong basis.

Stock Market Movements in March

In the stock market, March usually delivers major changes. Before the fiscal year is out, investors want to maximize portfolios. Reflecting a strong market rebound, the Nifty 50 and Sensex indexes each saw a rise over 7% in March 2025. Reduced foreign selling and bettering economic indicators helped in this upswing. Known for their intelligence, Gujarat’s investors actively joined in this surge. They showed flexibility in a market that was changing by adjusting holdings to seize new chances.

Clearing Dues and Managing Cash Flow

Settling outstanding debt takes first importance as the financial year ends. Companies work to pay off debt so they can maintain a good balance sheet. This strategy demonstrates financial stability and also develops ties with suppliers and partners. Efficient cash flow management at this time is crucial. Companies negotiate agreements, accelerate receivables, and manage working capital to guarantee liquidity. Such financial restraint positions them well for the challenges and opportunities of the next fiscal year.

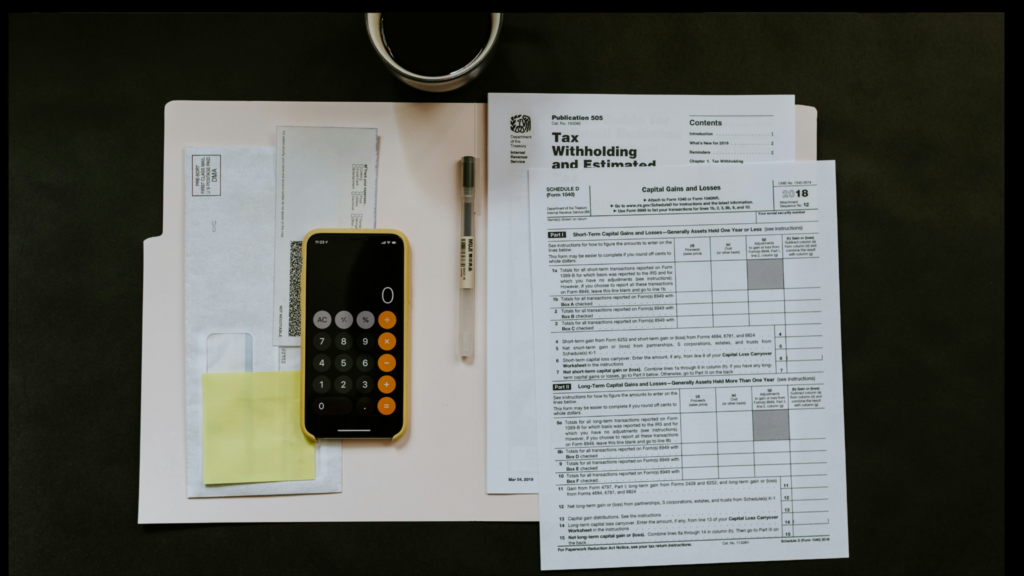

Tax Consultants and CAs: The Unsung Heroes

For tax consultants and chartered accountants (CAs) in Gujarat, March is the busiest month. They assist clients with tax planning, guaranteeing compliance with the newest rules. Effective from April 1, 2025, e-invoicing requirements must be uploaded by companies whose yearly revenue is ₹10 crore or above within 30 days of issue. Professionals like seasoned tax consultant Shailesh Gajjar play a crucial role at this time. His organization offers complete assistance, navigating businesses through complicated tax environments.

Balancing Festive Expenditures

March is also a month of holidays like Holi, contributing to higher consumer expenditure. Businesses, especially in retail, witness a rise in sales. However, this joyful passion needs cautious financial preparation. Companies weigh the benefits of festive sales against the requirement for budgetary restraint. They set resources for marketing and manage stocks to satisfy demand without overextending financially. This deliberate strategy guarantees that festive celebrations contribute favorably to the overall financial health.

GST Filings and Compliance

Compliance with Goods and Services Tax (GST) laws is crucial during year-end. Businesses must file returns, including GSTR-9, the annual return due by December 31 of the following financial year. The Gujarat State Tax Department provides services and helplines to assist taxpayers in completing their duties. Timely and correct filings prevent penalties and preserve the company’s compliance record.

Employee Bonuses and Salary Adjustments

Year-end is also when employers analyze performance and give bonuses. According to The Payment of Bonus Act, the minimum statutory bonus is 8.33% of annual salary whereas maximum is capped at 20% based on profitability. In consideration of these requirements, employers in Gujarat ensure compliance toward appreciation of employees and retention of morale. Timely incentive payouts indicate the company’s financial health and dedication to its staff.

Real Estate Transactions and Jantri Rates

The real estate industry sees increasing activity as the financial year finishes. Developers and buyers attempt to close transactions, driven by variables including the Annual Statement of Rates (Jantri). As of April 2023, Gujarat’s Jantri rates doubled which affected property prices and sales. It is important for stakeholders to grasp these rates to make optimal informed decisions and maximize tax benefits.

Expert Advice for Year-End Planning

Financial gurus advocate proactive preparation as the financial year finishes. They assist firms to undertake complete financial evaluations, maintain compliance with tax rules, and strategise for the future year. Engaging with experienced professionals helps negotiate the complexity of financial management, preparing firms for ongoing success.

Conclusion

In Gujarat the finishing dates of fiscal years are highly busy with strategic planning periods. Throughout the state, there is great precision and compliance to financial management which serves as the foundation for growth. The combined efforts of businesses along with financial and non financial experts and workforce during this period aids to strengthen the position of trade and industry in Gujarat. Fostering the stressors posed by the year’s business momentum blended with careful planning helps the state maintain the growing trend relative to other markets. Stay tuned with Gujpreneur for more!